Here is a table listing the 9 Best Crypto Derivatives Exchanges for Futures Trading in 2025:

| Exchange | Futures Trading Pairs | Leverage | Trading Fees | Security Features | KYC Requirement | Supported Assets |

|---|---|---|---|---|---|---|

| Binance Futures | 100+ | Up to 125x | 0.02% / 0.04% | 2FA, Cold Storage | Optional for small withdrawals | BTC, ETH, XRP, etc. |

| Bybit | 80+ | Up to 100x | 0.01% / 0.06% | Insurance Fund, Cold Wallets | No KYC for small trades | BTC, ETH, SOL, etc. |

| OKX | 150+ | Up to 125x | 0.02% / 0.05% | Anti-Phishing, Cold Storage | Required for full access | BTC, ETH, USDT, etc. |

| Bitget | 100+ | Up to 125x | 0.02% / 0.06% | Proof of Reserves, 2FA | Required for large trades | BTC, ETH, BNB, etc. |

| Deribit | 50+ | Up to 100x | 0.03% / 0.05% | IP Whitelisting, Cold Storage | Required | BTC, ETH only |

| KuCoin Futures | 100+ | Up to 100x | 0.02% / 0.06% | Anti-Bot Verification | Optional | BTC, ETH, DOGE, etc. |

| dYdX | 50+ | Up to 20x | 0.00% / 0.05% | Non-Custodial, Smart Contracts | No KYC | BTC, ETH, LINK, etc. |

| Phemex | 80+ | Up to 100x | 0.01% / 0.06% | Multi-Sig Wallets | Optional | BTC, ETH, USDT, etc. |

| MEXC Global | 200+ | Up to 200x | 0.02% / 0.06% | Insurance Fund, Cold Storage | Optional | BTC, ETH, SHIB, etc. |

9 Best Crypto Derivatives Exchanges for Futures Trading – 2025

Crypto derivatives trading has gained immense popularity, with traders seeking high leverage, low fees, and advanced security. Here’s a detailed breakdown of the 9 best crypto derivatives exchanges for futures trading in 2025.

1. Binance Futures

Overview: Binance Futures is the most popular derivatives exchange, offering a wide range of futures contracts with high liquidity and competitive fees.

- Futures Trading Pairs: 100+ (BTC, ETH, XRP, ADA, and more)

- Leverage: Up to 125x

- Trading Fees: Maker: 0.02% | Taker: 0.04%

- Security Features: 2FA, Cold Storage, Anti-Phishing Codes

- KYC Requirement: Optional for small withdrawals, mandatory for full access

- Why Choose Binance Futures? High liquidity, low fees, and an extensive range of assets make it ideal for professional traders.

2. Bybit

Overview: Bybit is a futures trading-focused exchange known for its user-friendly interface and no-KYC option for small traders.

- Futures Trading Pairs: 80+ (BTC, ETH, SOL, DOT, etc.)

- Leverage: Up to 100x

- Trading Fees: Maker: 0.01% | Taker: 0.06%

- Security Features: Insurance Fund, Cold Wallets, Multi-Sig Authentication

- KYC Requirement: No KYC for small withdrawals, required for large transactions

- Why Choose Bybit? No-KYC trading, smooth UI, and a strong derivatives trading ecosystem.

3. OKX

Overview: OKX offers a comprehensive futures trading platform with a variety of perpetual and quarterly contracts.

- Futures Trading Pairs: 150+ (BTC, ETH, USDT, SOL, etc.)

- Leverage: Up to 125x

- Trading Fees: Maker: 0.02% | Taker: 0.05%

- Security Features: Cold Storage, Anti-Phishing, Multi-Layered Security

- KYC Requirement: Required for full access

- Why Choose OKX? Offers a wide variety of futures contracts, deep liquidity, and robust security.

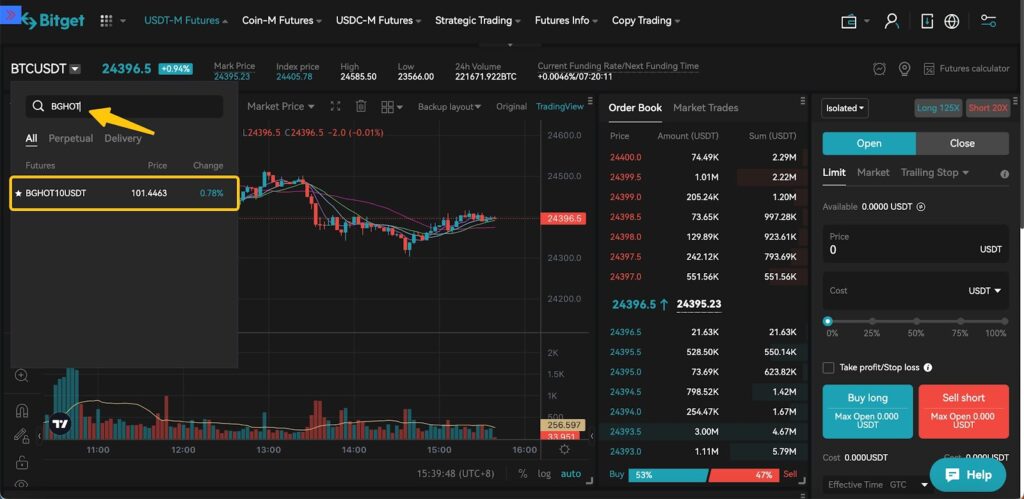

4. Bitget

Overview: Bitget is an emerging derivatives platform known for its copy trading feature and high leverage.

- Futures Trading Pairs: 100+ (BTC, ETH, BNB, MATIC, etc.)

- Leverage: Up to 125x

- Trading Fees: Maker: 0.02% | Taker: 0.06%

- Security Features: Proof of Reserves, 2FA, Cold Wallets

- KYC Requirement: Required for large withdrawals

- Why Choose Bitget? A great choice for copy traders and those looking for high leverage.

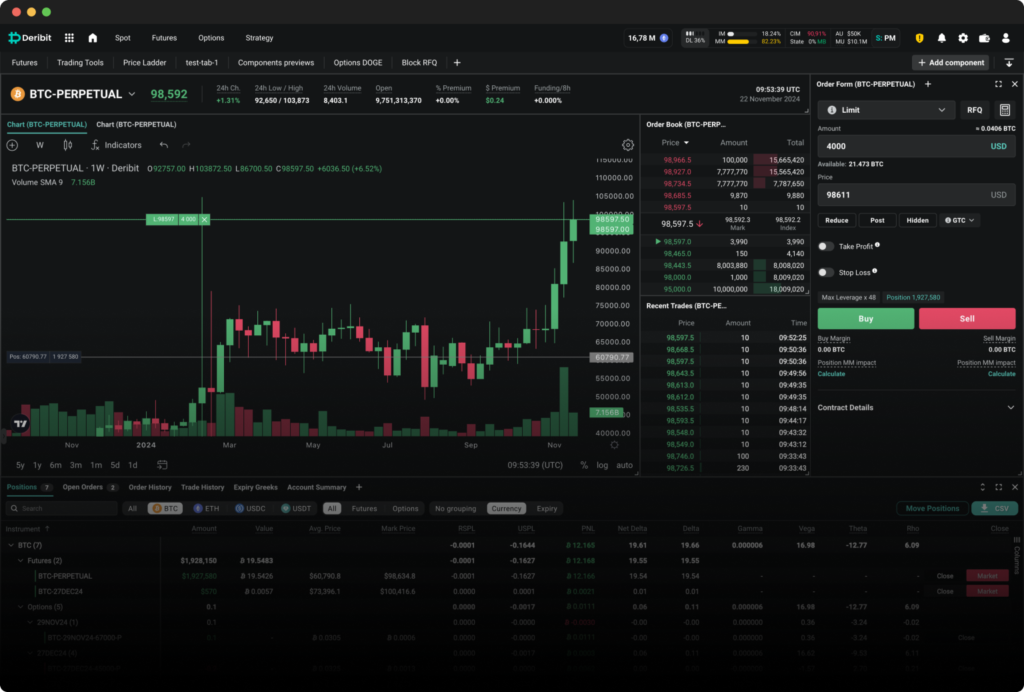

5. Deribit

Overview: Deribit is a derivatives-only exchange specializing in Bitcoin and Ethereum futures and options trading.

- Futures Trading Pairs: 50+ (BTC, ETH)

- Leverage: Up to 100x

- Trading Fees: Maker: 0.03% | Taker: 0.05%

- Security Features: IP Whitelisting, Cold Storage, Multi-Sig Wallets

- KYC Requirement: Required for all users

- Why Choose Deribit? Best for institutional traders and options traders focusing on BTC & ETH.

6. KuCoin Futures

Overview: KuCoin Futures offers a variety of trading options with a focus on altcoin futures.

- Futures Trading Pairs: 100+ (BTC, ETH, DOGE, SOL, etc.)

- Leverage: Up to 100x

- Trading Fees: Maker: 0.02% | Taker: 0.06%

- Security Features: Anti-Bot Verification, Risk Management System

- KYC Requirement: Optional

- Why Choose KuCoin Futures? A strong selection of altcoins and low trading fees make it attractive for retail traders.

7. dYdX

Overview: dYdX is a decentralized exchange (DEX) specializing in perpetual futures trading without requiring KYC.

- Futures Trading Pairs: 50+ (BTC, ETH, LINK, MATIC, etc.)

- Leverage: Up to 20x

- Trading Fees: Maker: 0.00% | Taker: 0.05%

- Security Features: Non-Custodial, Smart Contracts, Decentralized Order Books

- KYC Requirement: No KYC required

- Why Choose dYdX? Best for traders who prioritize privacy and non-custodial trading.

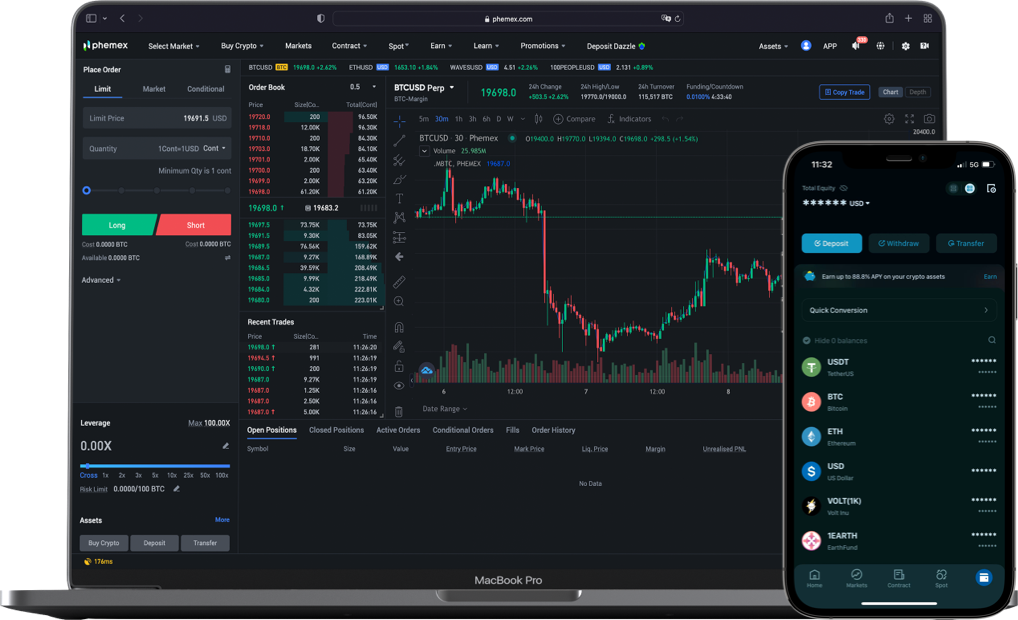

8. Phemex

Overview: Phemex is a derivatives trading platform with a unique subscription-based fee model.

- Futures Trading Pairs: 80+ (BTC, ETH, USDT, XRP, etc.)

- Leverage: Up to 100x

- Trading Fees: Maker: 0.01% | Taker: 0.06%

- Security Features: Multi-Sig Wallets, Cold Storage, Anti-Phishing Codes

- KYC Requirement: Optional

- Why Choose Phemex? Fast trading execution and a low-fee model make it a good alternative to Binance and Bybit.

9. MEXC Global

Overview: MEXC Global offers ultra-high leverage and supports a wide range of cryptocurrencies.

- Futures Trading Pairs: 200+ (BTC, ETH, SHIB, DOT, etc.)

- Leverage: Up to 200x

- Trading Fees: Maker: 0.02% | Taker: 0.06%

- Security Features: Insurance Fund, Cold Storage, Advanced Risk Management

- KYC Requirement: Optional

- Why Choose MEXC Global? Best for high-leverage traders looking for a vast selection of assets.

conclusion:

These 9 crypto derivatives exchanges offer excellent futures trading experiences, each catering to different trader needs. Binance Futures, Bybit, and OKX are top picks for liquidity and security, while dYdX is best for decentralized trading. Choose based on your trading style and security preferences!